Aksia’s clients are experienced institutional investors, benefiting from Aksia’s performance-focused expertise

9

Offices globally

Aksia provides a spectrum of services from non-discretionary to discretionary depending upon each client’s requirements, resources and preferences. Each relationship is customized by the client with respect to both the governance model of the engagement and the services we offer.

We allow our clients to build alternatives programs from the ground up or further develop their existing programs. Services include:

- Program development and planning

- Sourcing across primaries, co-investments and secondaries

- Investment Due Diligence

- Operational Due Diligence

- Portfolio & investment reporting

- Online pacing & cashflow modeling

- Risk transparency

- Strategy research

Aksia provides middle/back-office as well as data and technology solutions to help our clients’ portfolios achieve an efficient operating environment, which can include:

- Operations & accounting support

- Performance reporting & reconciliations

- Service provider coordination

- Structuring and formation of investment vehicles, together with fund counsel and tax advisors

- Capital calls management

- FX hedging

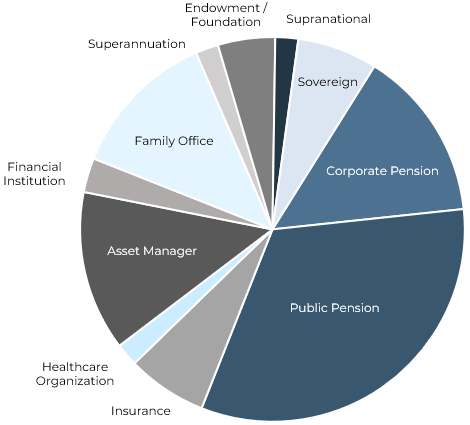

Clients by Type

As of April 30, 2025