Research Coverage

OUR IN-DEPTH INVESTMENT

AND OPERATIONAL RESEARCH

SPANS THE ALTERNATIVE

ASSETS LANDSCAPE

Private Credit Research Coverage

Direct Lending

U.S. Direct Lending

- Senior

- Opportunistic

- LMM (sponsored)

- LMM (non-sponsored)

- Private BDCs

- Industry Focused

- Revolvers

European Direct Lending

- Senior

- Opportunistic

- LMM

- Country-Specific Funds

Emerging Markets Lending

- Asian

- African

- CEE/Middle East

- Latin American

- Pan-EM

Global Direct Lending

Distressed Debt & Special Situations

Corporate Distressed

- Stress / Distressed Trading

- Influence / Control

- Diversified Distressed

Opportunistic Structured Credit

- 3rd Party CLO Equity

- Captive CLO Equity

- CLO Debt

- CLO Multi

- Consumer ABS

- CMBS/CRE

- Esoteric ABS

- European Structured Credit

- RMBS

- Structured Credit Multi-Sector

Real Estate Distressed

NPLs

Capital Solutions

PC Special Situations

PC Secondaries

Specialty Finance

Consumer & SME Lending

- Marketplace Finance

- Lender/Platform Finance

Rediscount Lending

Factoring & Receivables

Regulatory Capital Relief

Music/Film/Media Royalties

Oil & Gas Minerals Royalties

Metals Royalties

Healthcare Lending & Royalties

- Healthcare Lending

- Healthcare Royalties

Venture Lending

Technology Lending

Financial Services Credit

Insurance Linked Credit

- Diversified

- Life Insurance

- Non-Life

Litigation Finance

- Litigation Finance

- Merger Appraisal Rights

PE Portfolio Finance

Stretch ABL

Diversified Specialty Finance

Real Estate Credit

U.S. CRE Core Lending

Asia CRE Lending

U.S. CRE Transitional Lending

- Large Loan

- Middle Market

- Small Balance

- Opportunistic

U.S. CRE Bridge Lending

- Large Loan

- Middle Market

- Small Balance

European CRE Lending

- Bridge

- Transitional

- Core

Emerging Markets CRE Lending

CRE Structured Credit

- Agency CRE B-Piece

- Non-Agency CRE B-Piece

Residential Mortgages

- Residential NPLs

- Single Family Rental

- Mortgage Servicing Rights

- Residential Origination

Real Assets Credit

Infrastructure Lending

- Senior Focus

- Sub-IG Focus

- Junior Capital Focus

Energy Credit

- Energy Lending

- Energy Junior Capital Lending

- Opportunistic

Trade Finance

Metals & Mining Finance

Agricultural Credit

Transportation

- Aviation Lending

- Maritime Lending

- Road & Rail Lending

- Transportation Lending (Multi)

Junior Capital

U.S. Junior Capital

- Upper Middle Market

- Middle Market

- Lower Middle Market

European Junior Capital

Structured Equity

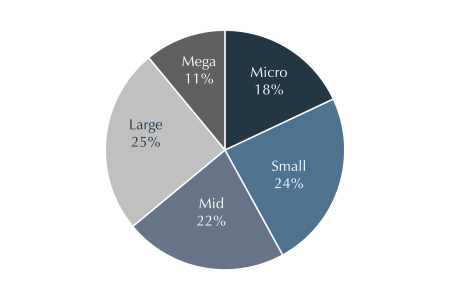

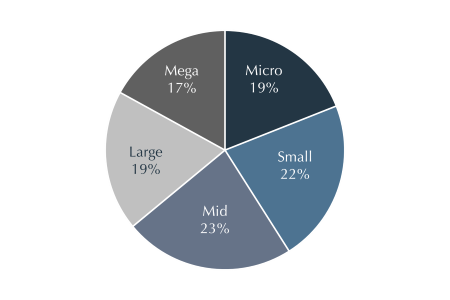

Manager AUM

- Micro: < 200 million

- Small: 200-500 million

- Mid: 500-1 billion

- Large: 1-3 billion

- Mega: > 3 billion

Private Equity Research Coverage

Buyouts

Geographic Focus

- Global Buyout

- North American Buyouts

- European Buyouts

- Asian Buyouts

- Emerging Markets Buyouts

Deal Strategies

- Traditional Buyout

- Buy & Build

- Carve Outs

- Recapitalizations

- Expansion

- Take Privates

- Long Duration

- PIPE

- Turnarounds

Market Cap Focus

- Lower Middle Market

- Middle Market

- Upper Middle Market

- Large

- Mega

Industry Scope

- Industry Specialist

- Generalist

Venture Capital

Stage Focus

- Early Stage VC

- Late Stage VC

- Multi Stage VC

Industry Scope

- Industry Specialist

- Generalist

Geographic Focus

- North America

- Asia & Pacific

- Europe

- Global/Other

Growth Equity

Geographic Focus

- Global Growth Equity

- North American Growth Equity

- European Growth Equity

- Asia Growth Equity

- Emerging Mkts Growth Equity

Junior Capital

Strategies

- US Junior Capital

- European Junior Capital

- Structured Equity

PE Special Situations

Strategies

- PE Special Situations

- Corporate Distressed

- Real Estate Distressed

- Capital Solutions

GP Stakes

Strategies

- Portfolio

- Single GP

Private Equity Secondaries Funds

Strategies

- PE Secondaries Fund

- PE Secondary Port. Purchase

Geographic Focus

- North America

- Asia & Pacific

- Europe

- Global/Other

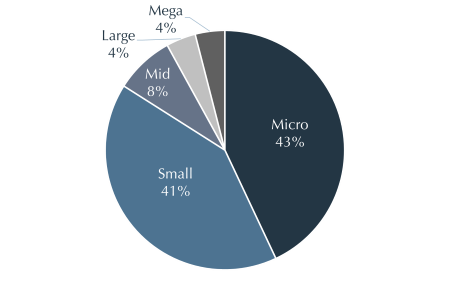

Manager AUM

- < 1 billion

- 1-5 billion

- 5-10 billion

- 10-15 billion

- >15 billion

Hedge Fund Research Coverage

Long / Short Equity

Opportunistic

Fundamental Growth

Fundamental Value

Low Net

Multi-PM

Specialist

- Consumer

- Financials

- Healthcare

- Natural Resources

- Real Estate

- TMT

Event Driven

Event and Merger

- Debt & Equity

- Event & Merger

- Hedged

Event Credit

- Event Credit

- Financial Credit

- Distressed & Restructuring

- High Yield & Stressed

Activist

Relative Value

Long/Short Credit

- Convertible Arbitrage

- Credit Trading

- Multi-Asset Class RV

Structured Credit

- Commercial Real Estate

- Corporate Structured Credit

- Diversified Structured Credit

- Residential Structured Credit

Fixed Income Arbitrage

- G10 Fixed Income Arbitrage

- Mortgage Derivative RV

Insurance Linked

- Diversified Insurance

- Life Insurance Linked

- Non-Life Insurance Linked

Quantitative Strategies

- Diversified Quant Strategies

- Fundamental Market Neutral

- Statistical Arbitrage

Volatility

Tactical Trading

CTA

- Diversified

- Short Term

- Trend Following

Active Commodities

- Commodities L/S

- Long-Biased Commodities

- Relative Value Commodities

Global Macro

- Asia Macro

- G10 Macro

- Emerging Markets Macro

- Systematic Macro

Risk Mitigators

- Short-Biased Credit

- Short-Biased Equity

- Tail Risk

Multi-Strategy

Relative Value Multi-Strategy

- Non-PT RV Multi-Strategy

- Pass Through RV Multi Strategy

Multi Risk Premia

- Multi Risk Premia

Asia Multi-Strategy

- Asia Multi-Strategy

Directional Multi-Strategy

- Directional Multi-Strategy

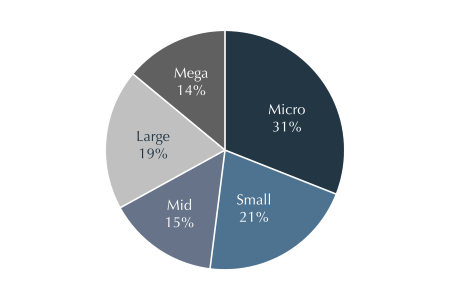

Manager AUM

- Micro: < 200 million

- Small: 200-500 million

- Mid: 500-1 billion

- Large: 1-3 billion

- Mega: > 3 billion

Real Assets research Coverage

Infrastructure

Diversified Infrastructure

- Diversified

Oil & Gas Midstream

- Gathering and Processing

- Storage

- Long-haul pipelines

- Rail, Trucking, Barges

- LNG

- Diversified

Power

- Conventional

- District Heating

- Transmission & Distribution

- Diversified

Energy Transition

- Renewable Generation

- Battery Storage

- Low Carbon Fuels

- E-Mobility

- Carbon Capture & Sequestration

- Environmental Services

- Clean Technology

- Diversified

Communications

- Data Centers

- Towers

- Fiber

- Small Cells

- Spectrum

- Managed Services

- Diversified

Social

- Government

- Education

- Healthcare

- Cultural & Recreational

- Diversified

Transportation & Logistics

- Airports

- Seaports

- Parking

- Roads

- Rail

- Aviation Services

- Equipment Leasing

- Aircraft Leasing

- Shipping

- Cold Storage

- Diversified

Water

- Water & Waste

- Diversified

Natural Resources

Agriculture

- Agribusiness

- Farmland

- Indoor Farming

- Permanent Crops

- Ranchland

- Diversified

Water

- Desalination

- Water Rights

- Diversified

Mining & Minerals

- Base Metals

- Bulk Commodities

- Precious Metals

- Rare Earths

- Diversified

Timber

- Natural Forests

- Timber Plantations

- Diversified

Oil & Gas

- Upstream

- Downstream

- Services

- Diversified Oil & Gas

Real Estate

Primary Property Type

- Data Centers

- Diversified

- For-Sale Residential

- Hospitality

- Industrial

- Land

- Life Sciences / Lab

- Medical Office

- Multifamily

- NNN

- Office

- Other

- Parking

- Retail

- Self Storage

- Senior Living

- Single-Family Rental

- Student Housing

Risk Profile

- Core

- Core+

- Value-Added

- Opportunistic

RE Strategy Details

- Property-Type Focused

- Develop to Hold

- Develop to Sell

- Property Technology (PropTech)

- Operating Companies

- GP Fund

Manager Profile

- Direct Operator

- Allocator

- Hybrid

Geographic Focus

- Global

- North America

- Europe

- Asia-Pacific

- Latin America

US Regional Focus

- National

- East

- Midwest

- South

- West

Real Assets Credit

Infrastructure Lending

Energy Credit

Trade Finance

Metals & Mining Finance

Agricultural Credit

Transportation Credit

U.S. CRE Core Lending

U.S. CRE Transitional Lending

U.S. CRE Bridge Lending

European CRE Lending

Emerging Markets CRE Lending

Residential Mortgages

Specialty Finance

Metals Royalties

Oil and Gas Minerals & Royalties

Music/Film/Media Royalties

Infra/NR Manager AUM

- < 1 billion

- 1-5 billion

- 5-10 billion

- 10-15 billion

- >15 billion

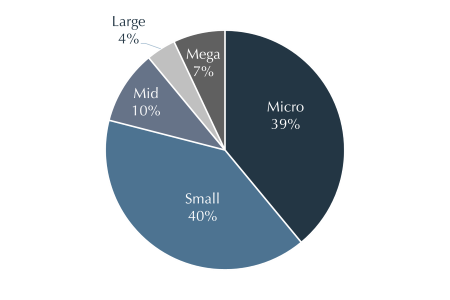

Real Estate Manager AUM

- Micro: < 200 million

- Small: 200-500 million

- Mid: 500-1 billion

- Large: 1-3 billion

- Mega: > 3 billion

As of December 31, 2025. Coverage by geography and fund size is representative of the universe of investment programs (where a program is defined as a group of funds managed by the same manager which pursue a similar investment strategy, leverage, and/or investor pooling) on which Aksia has conducted due diligence (IDD, ODD, or Insight Report).

Each investment program is uniquely counted in its primary asset class (e.g., real estate credit funds are included in the private credit asset class coverage figures only).